MPERS utilizes a 2-Step Retirement Process. This process allows MPERS to provide you with more individualized information. If you have any questions regarding the 2-Step Retirement Process, please contact an MPERS benefit specialist at (573) 298-6080 or (800) 270-1271.

Step 1: Notice of Retirement: To start the retirement process:

- Complete a Notice of Retirement Form. This form can be submitted online through myMPERS Secure Member Access, or if you prefer, you may download a form to complete and mail to MPERS.

- Submit an acceptable proof-of-age document, a copy is acceptable for all proof-of-age documents. If you are married, submit an acceptable proof-of-age document for your spouse and a copy of your marriage certificate. Acceptable proof-of-age documents include a valid (non-expired) Missouri driver’s license, US birth certificate, or US passport (valid or expired).

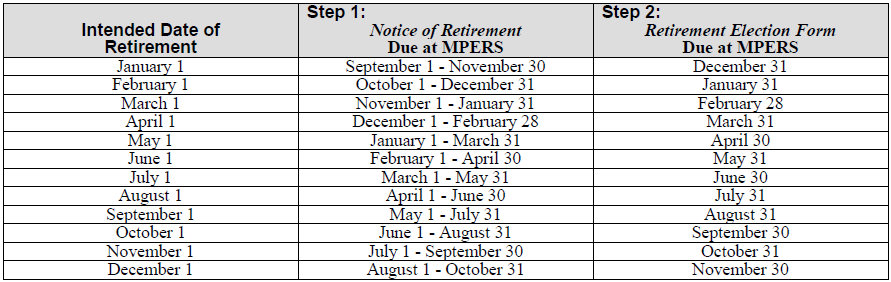

- Send the completed form and copies of proof document(s) to MPERS by the deadline listed on the Date Forms are Due at MPERS chart below that coincides with your intended date of retirement. For example, if you intend to retire April 1, your Notice of Retirement must be submitted to MPERS by February 28.

MPERS will use your intended date of retirement and spouse information to prepare your individualized Retirement Election Form, benefit estimate(s), and accompanying forms for Step 2. All retirements occur on the first calendar day of the month.

Step 2: Retirement Election Form

MPERS will send you an individualized Retirement Election Form and benefit estimates(s) in the mail. The form will show all retirement options for which you are eligible (e.g. benefit payment options, retirement plan, and BackDROP). If you are eligible for BackDROP, you will also receive a BackDROP Distribution Form and Special Tax Notice brochure. The benefit estimate(s) are designed to provide you the information you need to help you make an informed retirement decision.

- Complete the Retirement Election Form.

- Complete the BackDROP Distribution Form (if applicable). If electing the rollover option, the receiving financial institution must also complete this form.

- Complete the W4P Substitute Form (tax withholding).

- Complete the Direct Deposit Authorization Form.

- Complete the $5,000 Beneficiary Designation Form (if applicable)

- Complete the Designation of Agent Form (optional)

- Send the forms to MPERS by the deadline listed on the chart that coincides with your intended date of retirement. For example, if your intended date of retirement is April 1, your Retirement Election Form and any remaining documentation must be submitted to MPERS by March 31.

Date Forms are Due at MPERS

Based on your intended date of retirement, your Notice of Retirement and Retirement Election Form must be received at MPERS by the dates listed on the chart below. Submitting either form after the deadline will delay your retirement date.

Net Benefit Calculator

To help determine their income in retirement, our members asked what their estimated monthly retirement check would be net of taxes and deductions. We don’t blame them – deciding to retire can be a stressful decision and determining their monthly income is pretty high up on the list of priorities.

Everyone’s situation is different so we cannot simply say “count on withholdings of x% from your gross retirement check and that is what will appear in your bank account.” What we can offer is access to two tax withholding calculators.

One calculator is available on our website. The other calculator is available through myMPERS Secure Member Access. If an active member logs in, he/she can use the “Gross-to-Net Benefit” calculator to estimate the net retirement check. The member will have to input an estimated gross amount, federal and state tax withholding data and will want to estimate the other deductions such as medical and life insurance premiums. If a retired member logs in, he/she can go through the same steps and make all of the adjustments, click a button and the changes will be made – no extra forms to fill out!

Deductions From Your MPERS Benefit

Medical Insurance Plan premiums: You will need to contact your insurance representative for an appointment to set up your insurances for retirement and discuss annual leave and comp-time payouts.

Phone: MoDOT (877) 863-9406

Website: www.modot.org/newsandinfo/benefits.htm

Optional Life Insurance premiums: You will need to contact your insurance representative for an appointment to set up your insurances for retirement.

Phone: MoDOT (877) 863-9406

Website: www.modot.org/newsandinfo/benefits.htm

NOTE: The premiums for the following non-state sponsored benefits are not eligible for deduction from your monthly benefit payment.

- (MoDOT) Voluntary Life Plan

- (MSHP) Met-Life/BMA Life Insurance

- (MoDOT) Central United Life Insurance (cancer insurance)

- (MSHP) CONSECO Life Insurance (cancer insurance)

Other Administrators to Contact Before You Retire (if applicable)

Deferred Compensation Plan: If you want your payroll deduction amount changed on your terminal leave paycheck (payout for your annual leave and comp time), you must contact a Missouri Deferred Compensation Plan Representative.

Phone: (800) 392-0925

Website: www.modeferredcomp.org

Social Security: Contact your local Social Security Office at least 90 days prior to the date you want to begin receiving benefits. You do not have to start taking social security benefits at the same time you retire from MPERS.

Phone: (800) 772-1313

Website: www.ssa.gov

Medicare Enrollment: Part A coverage is automatic at the time you reach age 65. If you plan to retire at age 65, enroll in Part B in advance of retirement. If you work past age 65, you should enroll in Part B prior to retirement so coverage will be in place at the time of your retirement.

Universal Life Insurance: If you are enrolled in the Trustmark Insurance Company (universal life insurance) and want to cancel, you will need to write to the respective company and request cancellation; if you plan to continue coverage, you will need to contact them and set up a payment plan. Payroll deduction through MPERS is not available for this insurance.

Phone: (800) 918-8877

Cafeteria Plan: If you participate in the Cafeteria Plan prior to retirement, you may also be eligible to pre-pay your medical insurance premiums through the Cafeteria Plan in the year that you retire. Your insurance representative can discuss this with you.

Phone: (573) 442-3035 or (800) 659-3035

Website: www.mocafe.com.

Highway Credit Union: If you have a credit union deduction as an active employee, you will need to advise the credit union you are retiring and work with them to determine the best way to continue funding your credit union account.