Divorce and Your MPERS Benefit

Are you “vested” with the MoDOT and Patrol Employees’ Retirement System (MPERS)? If so, your retirement benefit from MPERS is considered “marital property.” If you have been married at any time while earning service credit under MPERS and you are considering a divorce, your spouse may be legally entitled to receive a portion of your retirement benefit.

Explanation of the Division of Benefits Order (DBO) Provision

Sections 104.312 and 104.1051 of the Revised Statutes of Missouri (RSMo), permits the division of MPERS’ retirement benefits in the event of a divorce. This law allows MPERS to pay a portion of your pension benefit directly to your former spouse at the time you begin receiving payments from MPERS. If you are already retired, the benefits to your ex-spouse will begin the first of the month after we receive an acceptable Division of Benefits Order (DBO).

Before MPERS can divide your benefit, a court of competent jurisdiction must issue a DBO. According to the law, the court may award your ex-spouse up to 50% of the MPERS benefit accrued during all or part of your marriage.

Alternative to the DBO

There are two important details to remember when considering whether or not to use a DBO:

1. No payment will be issued to your ex-spouse until you begin receiving retirement benefits from MPERS.

2. The only way in which MPERS is legally authorized to divide your benefit is by using a certified and approved DBO.

However, as an alternative to the DBO, you may choose to divide the present value of your retirement benefit at the time of divorce as a part of the property settlement. If a present value calculation is required, we recommend you contact a professional who specializes in this service. MPERS cannot provide a present value calculation.

There may be other alternative methods available to you as well. Please consult your attorney to decide which method of dividing your benefit is best.

Are You Vested?

In order to divide your benefit, you must be “vested” on the date of your divorce. In other words, you must be eligible to ultimately receive a benefit from MPERS without regard to future service. You will be “vested” in MPERS after accruing 5 years of credited service.

If you are not vested on the date of divorce, your retirement benefit cannot be divided. If you are not vested, you are not entitled to a benefit; therefore, there is nothing to divide.

If the service accrued during the marriage was under the Closed Plan, the ex-spouse payment will be calculated according to the plan the member is in on the date of dissolution, regardless of the plan elected at retirement.

How to Obtain Benefit Information

MPERS requires a Request for DBO Estimate form or subpoena to release your benefit information to another party. Your ex-spouse can use the release form in lieu of requesting the court to issue a subpoena to MPERS. A Request for DBO Estimate form is available on our website (www.mpers.org) or you may contact MPERS’ office.

Generally speaking, the DBO estimate will show the:

- Amount of creditable service.

- Benefit formula.

- Accrued monthly retirement benefit attributable to the period of the marriage.

If you or your attorney requests the benefit information, we will send it to you. If your spouse or your spouse’s attorney requests the benefit information, we will send you a copy of the information that we release.

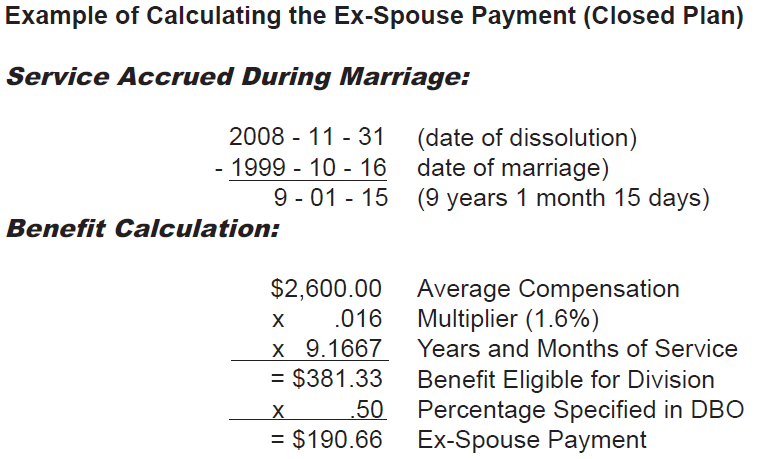

How to Calculate the Ex-Spouse Payment

With an approved DBO, your ex-spouse may receive up to 50% of the MPERS benefit accrued during all or part of your marriage. The benefit for service accrued before the marriage and after the date specified on the DBO cannot be divided. The ex-spouse benefit will be based upon the formula of the plan in which the member belongs on the date of dissolution.

Example of Calculating the Ex-Spouse Payment (Closed Plan)

In the event of a divorce, service purchased or transferred during the marriage will be included in calculating the ex-spouse benefit.

The ex-spouse payment amount will be adjusted proportionately if the member

- Elects early retirement, or

- Elected a joint and survivor option at retirement and the ex-spouse was named as beneficiary.

The reduction will be applied to the member and ex-spouse benefit.

How to Submit a DBO

To assist you in obtaining an acceptable DBO, we recommend you follow these steps:

- Discuss the divorce proceedings with your attorney. Ask about your rights and options regarding “marital property.”

- Obtain a DBO packet and benefit estimate from MPERS. To receive this information, submit a Request for DBO Estimate or subpoena to MPERS. The Request for DBO Estimate form and the DBO sample are available on MPERS’ website.

- Have your attorney prepare a DBO according to the sample DBO provided in the packet (also on our website). An altered DBO will not be accepted.

- Have the DBO signed by the appropriate parties, including the judge.

- Obtain a certified copy of the DBO from the circuit clerk.

- Submit the certified copy to MPERS for processing. MPERS will not process a DBO until a certified copy is received at MPERS’ office.

When Will Payments to an Ex-Spouse Begin?

Ex-spouse payments under a DBO will begin the later of:

- The month following the date the DBO is issued (if already retired).

- When MPERS receives the DBO and it is practical to implement (ex-spouse payments cannot be paid until you begin receiving retirement benefits from MPERS).

Benefit payments under a DBO will not be paid retroactively.

Divorce Before Retirement

In accordance with the DBO provisions, ex-spouse payments will commence when you begin receiving retirement benefits from MPERS. Upon your death, or the death of your ex-spouse, the DBO will automatically terminate.

Divorce After Retirement

Payments to your ex-spouse will begin the first of the month following receipt of an acceptable DBO. MPERS will only divide retirement benefit payments paid after receipt of the DBO. Upon the death of either party, the DBO will automatically terminate. If you are predeceased by your former spouse, your benefit will increase by the amount otherwise payable to the ex-spouse on the first of the month following the ex-spouse’s death.

Survivor benefits are paid in accordance with applicable statutes. For example, if you elect(ed) a Joint & Survivor benefit payment option at retirement, survivor benefits may be paid to the spouse named accordingly, regardless of your marital status. However, effective January 1, 2021, if you elected a joint and survivor benefit payment option, your benefit can revert (pop up) to the higher life income annuity amount upon submitting a completed Divorce – Survivor Option Reversion form and a copy of the divorce decree to MPERS. The divorce decree must be approved by MPERS’ counsel and must provide sole ownership by the member to all rights in the annuity and must further provide that the former spouse shall not be entitled to any survivor benefits.

Divorce and Your Survivor Benefit

Upon your death, survivor benefits will be paid to the eligible beneficiary according to the provisions of the Revised Statutes of Missouri (regardless of your marital status).

In the event of a divorce, you may want to change the beneficiary designations on your $5,000 death benefit from MPERS (if eligible), any life insurance policies, and your deferred compensation account.

Please keep your beneficiary designations current.

Information About MPERS

MPERS is a “defined benefit” (DB) plan operating as a tax qualified plan under Section 401(a) of the Internal Revenue Code. In a DB plan, those who vest and meet certain age and service requirements are guaranteed a retirement benefit. This benefit is generally determined by a formula, which takes into account your compensation and your years and months of service.

If you are a member of MPERS’ Closed Plan and Year 2000 Plan, you do not contribute to your retirement benefit. Retirement benefits are financed solely by employer contributions and investment earnings on those contributions. Because contributions made by your employer fund benefits for all members, you do not have an individual account.

If you are a member of MPERS’ contributory 2011 Tier, you do have an account. There are no provisions that allow your ex-spouse to receive any portion of your contributions, unless he/she is designated as your beneficiary. You may change your beneficiary designation at any time by completing and submitting a Change of Beneficiary for Contribution Account form.

Acting as an administrative agent, MPERS oversees the following three retirement plans:

- Closed Plan

- Year 2000 Plan

- 2011 Tier (contributory tier of Year 2000 Plan)

Please remind your attorney that as a governmental retirement plan, MPERS

is not subject to any Qualified Domestic Relations Order (QDRO) issued pursuant to the provisions of the Employee Retirement Incentive Security Act of 1974 (ERISA).

Summary of DBO Provisions

MPERS will not automatically divide your retirement benefit in the event of divorce. The only way in which MPERS is legally authorized to divide your benefit is by using a Division of Benefits Order (DBO).

- The division amount is negotiable at the time of divorce. It can be any amount up to 50% of your MPERS benefit accrued during all or part of your marriage.

- There may be other alternative methods available to divide the value of your retirement benefit. Ask your attorney about your rights and options.

- If you marry and divorce more than once, the court can authorize more than one DBO through MPERS. Each order can only divide the benefit accrued during that marriage.

- No payment will be issued to your ex-spouse until you begin receiving benefits from MPERS.

- In order to have your benefit divided, you must be eligible for a benefit (vested) on the date of dissolution (as specified on the DBO).

- A DBO can be obtained and submitted to MPERS after the divorce. The DBO is not automatically part of the divorce.

- The DBO will automatically terminate upon the death of either party.

- Your ex-spouse will not be eligible to receive formula increases, the temporary benefit, any portion of your BackDROP payment, or your contributions (if applicable).

- Ex-spouse payments are eligible for cost-of-living adjustments (COLAs) based on the plan in which you receive a retirement benefit (if DBO occurred on or after September 1, 2001).

- The ex-spouse payment will be adjusted proportionately if you:

- Elect(ed) early retirement, or

- Elect(ed) a joint and survivor benefit payment option at retirement and the ex-spouse was named as beneficiary.

- An MPERS retiree cannot change (even after divorce) the benefit payment option after the first benefit payment is paid by MPERS.*

- It is important that you and your ex-spouse keep MPERS updated on any address changes. We will contact both of you if there is a change in benefit amount or status.

- Members of the 2011 Tier cannot request a refund of employee contributions if there is a certified DBO on file at MPERS.

*See the Designation of New Spouse for Survivor Options and Pop-up Provision – Death of Spouse Sections of the handbook for exceptions to this rule.