Asset Allocation

As of 6-30-2024

The time horizon of the Systems’ investment portfolio reflects the long-term nature of the MPERS pension obligations. Accordingly, diversification among investments displaying unique risk and return characteristics provides the framework for selecting an asset allocation that is expected, in the aggregate, to give the funds the highest long-term return within a prudent risk level.

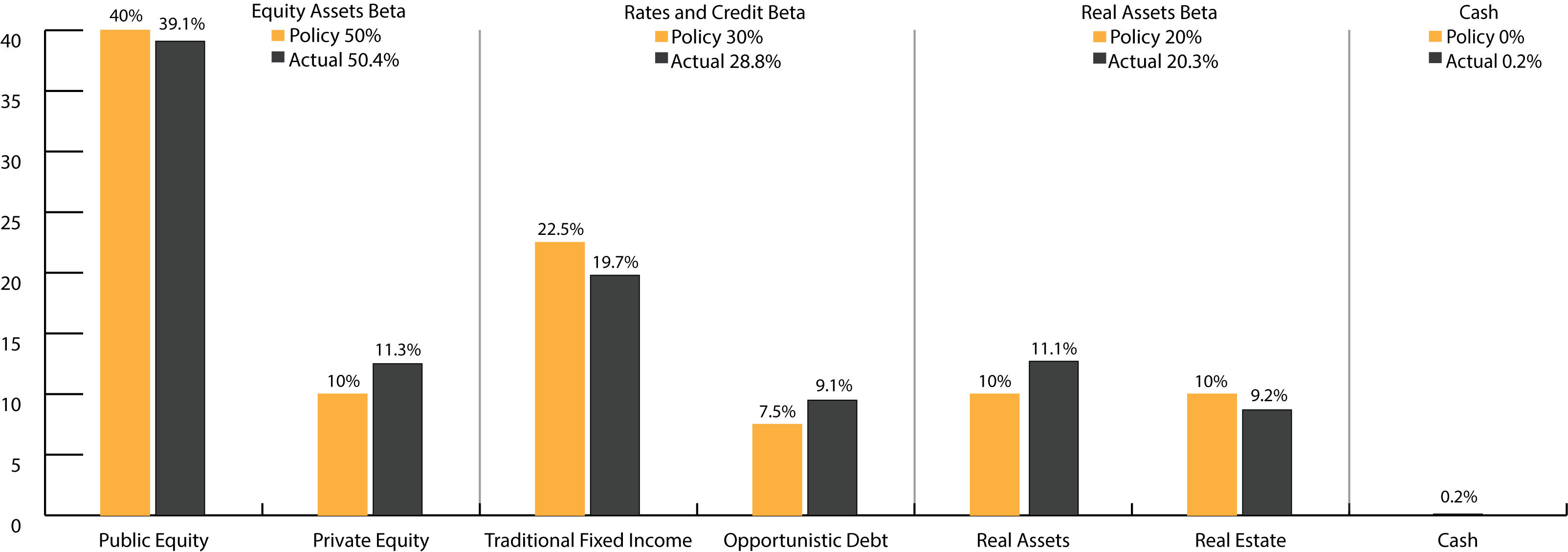

The Board approved allocation is reported in a beta group construct. The beta groups are equities, rates and credit, and real assets. These groupings provide a framework to align the various portfolio exposures, regardless of the structure of the investment vehicle, and allows for more transparent reporting of alternative assets according to their underlying market (or beta) exposure.

The policy target allocation represents the Board approved allocation and allows for a minimal variance around each asset class target. The actual allocation represents the actual position of the assets as of a set date. Staff is expected to maintain the actual position within the boundaries of the targeted asset allocation.

The Systems’ asset allocation is reviewed annually with updated capital market projections and are reviewed more formally in conjunction with plan liabilities at least every five years through what is called an asset liability study.